If you are researching the Assist Card insurance company better before closing your Travel Insurance application, you have come to the right place. We've gathered all the important company information in this complete guide for you to check out.

The Assist Card travel insurance is one of the most popular and sought after by travelers. It is available for hire at online insurance comparators and has plans that meet all travel needs, at super fair prices. The company specializes in travel care, and has been in the market for over 40 years.

Assist Card insurance offers good coverage and great value for money, however, it is necessary to pay attention to some details before hiring it, to make sure that it fits with what you are looking for for your trip abroad. The Assist Card has a variety of plans and coverage options for international travel, such as multi trip travel insurance, annual travel insurance among others.

We tell you all about Assist Card's travel insurance plans here, in this post, in an analysis that weighs the advantages and disadvantages of the insurer, including taking into account its profile on Reclame Aqui. If you're looking for more information before hiring your plan, check everything out here to clear your doubts!

In this post you will see:

- Is the Assist Card reliable?

- Where to buy Assist Card travel insurance

- Assist Card discount coupon

- What the Assist Card offers

- How to activate the Assist Card insurance?

- Best Assist Card plans

- Do Assist Card plans cover coronavirus?

- Assist Card reputation in Reclame Aqui

- FAQ

Is the Assist Card reliable?

Assist Card España is an insurance company that works exclusively with assistance and travel insurance. Its history is long, with more than 45 years of experience and 1200 employees, distributed in more than 190 countries. In all, the company accumulates more than 10 million policies sold.

Assist Card is available 24 hours a day, 7 days a week, and always in Portuguese. It offers assistance by videoconferencing (telemedicine) and also via mobile application. All this to speed up the service and make the traveler more relaxed when he needs it.

In addition, the company offers concierge service, monitoring of minors and is still one of the few with a wide accredited network and online refund request. It's these small details that make the difference in emergency situations.

Assist Card's experience makes it one of the leading insurers in Spain. Even when using online insurance comparator, AC plans are often cost-effective for destinations around the world.

Where to buy Assist Card travel insurance

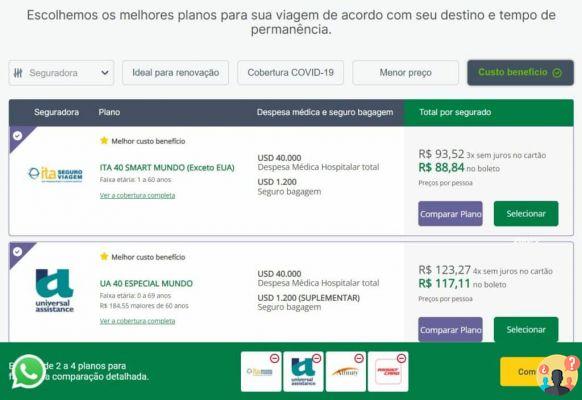

To buy your Assist Card travel insurance at the best possible price, the best way is to pick it up at online insurance comparator. In it you can have a very broad view of the insurance plans available on the market, in addition to seeing details and particularities of each option.

The comparator is a super cool tip because it also allows you to know more about other insurers besides the Assist Card, and thus choose the most ideal travel insurance for you.

This is all done as a no-obligation quote, and apart from that, the comparator itself has a highly qualified team to help you choose travel insurance and answer all your questions.

Assist Card discount coupon

Better than being covered against possible emergencies during the trip, it is better to hire insurance at the best price on the market. For this, Travel Tips readers can use the coupon FORTRAVELOVERS and guarantee 5% off the final price. Too much, huh?

Oh, and there is an additional 5% discount for those who pay with boleto, pix or transfer, and these discounts are cumulative. In other words, you can guarantee savings of up to 10% when purchasing your travel insurance. Also remembering that the purchase of insurance can be paid in up to 12 installments, making payment as easy as possible.

- Click to redeem coupon FORTRAVELOVERS and get 5% off

- Pay by boleto, Pix or wire transfer to earn an extra 5% and reach the 10% off!

What the Assist Card offers

Assist Card offers several very complete travel insurance plans. It has options for Europe travel insurance, student travel insurance, maritime travel insurance, maternity travel insurance and also multi trip travel insurance, among others.

The plans include medical and hospital assistance, luggage insurance, concierge service, accompanying minors in emergency situations and even insurance for cell phone or computer theft. There are some that are more complete than others, so it's super important to carefully review all the coverages available.

A differential of Assist Card is the Self-Management Service, which can be used through the insurance company's mobile application. With it, it is possible to carry out medical consultations by video conference (telemedicine) anywhere in the world and at any time.

In addition, with Self-Management, the traveler himself can activate other policy items, such as luggage insurance, insurance for theft of mobile devices, repatriation, among others.

Check out the main plans of Assist Card travel insurance:

- AC 35 World: Hospital medical coverage of up to $35

- AC 35 Europe: hospital medical coverage of up to 35 thousand euros

- AC 35 US with deductible*: Hospital medical coverage of up to $35

- AC 50 with deductible*: hospital medical coverage of up to $50

- AC 60 World: Hospital medical coverage of up to $60

- AC 60 Am. North with franchise*: Hospital medical coverage of up to $60

- AC 60 Europe: hospital medical coverage of up to 60 thousand euros

- AC 100 World with franchise*: Hospital medical coverage of up to $100

- AC 150: Hospital medical coverage of up to $150

- AC 250: Hospital medical coverage of up to $250

* $100 DMH deductible per event.

Assist Card also offers multi-trip plans and annual travel insurance:

- AC 150 MT 30: medical coverage of up to $150 for multiple trips within a year

- AC 250 MT 30: medical coverage of up to $250 for multiple trips within a year

- AC 150 Long Stay: medical-hospital coverage of up to US$150 for a long-term stay within a period of one year

- AC 250 Long Stay: medical-hospital coverage of up to US$250 for a long-term stay within a period of one year

How to activate the Assist Card insurance?

In case of emergencies abroad, to contact the Assist Card, simply call 0800 770 1664, which is available on your own policy. In addition, it is one of the insurance companies that have the most modern alternatives to guarantee traveler service, such as the Assist Card application. With it, it is even possible to receive consultation by telemedicine.

If there is any difficulty in contacting the insurance company through the most common means of communication, a good tip is to ask for help from the support of the online insurance comparator – that is, if you closed the purchase through their own website. They are super helpful and willing to help travelers, and they offer thoughtful treatment for anyone who needs insurance.

Best Assist Card plans

to help you about which travel insurance to choose, we select the plans with the best cost-benefit and full coverage that Assist Card offers, separating by destination and type of trip.

Remembering that some Assist Card plans have a deductible for the use of medical and hospital assistance. Therefore, it is important to consider this value when hiring.

Europe travel insurance

AC 35 Europe + Telemedicine

- no deductible

- Meets the requirements of Schengen Treaty

- Coverage of medical and hospital expenses (DMH) of up to 35 thousand euros

- Medical coverage for accidents in sports practices of up to 30 thousand euros

- Medical coverage for pregnant women up to €30 (up to the 28th week of pregnancy, with no age limit for the mother)

- Sanitary return of up to 30 thousand euros

- Body transfer up to 10 thousand euros

- Lost luggage insurance of 1.200 euros

- 200 euro baggage delay refund (one-way flight only)

United States travel insurance

AC 60 Am. North with franchise + Telemedicine

- Deductible for medical and hospital expenses (DMH) of 100 dollars per event

- Coverage of hospital medical expenses of up to $60

- Medical coverage for sports accidents of up to $60

- Medical coverage for pregnant women up to $30 (up to the 28th week of pregnancy, with no age limit for the mother)

- Sanitary return of up to 30 thousand dollars

- Body transfer up to 10 thousand dollars

- $1.200 lost luggage insurance

- $200 baggage delay refund (one-way flight only)

student travel insurance

AC 150 Long Stay (annual travel insurance)

- no deductible

- Coverage for medical and hospital expenses of up to US$150

- Medical coverage for sports accidents of up to $30

- Medical coverage for pregnant women up to $30 (up to the 28th week of pregnancy, with no age limit for the mother)

- Dental coverage of up to $700

- Sanitary return of up to 60 thousand dollars

- Body transfer up to 15 thousand dollars

- $1.200 lost luggage insurance

- $200 baggage delay refund (one-way flight only)

- Accompanying or family accommodation up to 500 dollars (maximum of 10 nights)

Sports travel insurance

All Assist Card travel insurance plans have medical coverage for accidents that occur while practicing sports.

Other options that offer complete coverage for amateur athletes are: Affinity e GTA Travel Insurance, which are also good indications.

Travel insurance for pregnant women

AC 35 World + Telemedicine

- no deductible

- Medical coverage for pregnant women up to $60 (up to the 28th week of pregnancy, with no age limit for the mother)

- Includes emergency care, premature births, abortions and urgent examinations

Do Assist Card plans cover coronavirus?

There are some Assist Card plans available that do provide coverage for Covid-19 cases diagnosed abroad. They are specific products, and it is usually indicated in the title itself if it has coverage for the new coronavirus.

To make sure you're taking out a plan that covers Covid patients, check out the details provided on the online insurance comparator, or even talk to support to confirm that it's the right travel insurance option.

Quarantine travel insurance

There is also a novelty of the Assist Card for travelers who need to comply with quarantine abroad. The safe AC Covid-19 QUARANTINE is a special plan, which provides coverage for expenses such as hotel rates and flight rebooking, for travelers who need to be in isolation at their destination.

This plan is highly suitable for travelers who need to be tested for Covid before traveling back to España. Thus, those who get a positive result for the coronavirus and need to wait 72 hours before taking another test, can use the benefits of this Assist Card service.

- Refund of fare difference or fine for changing the date of the air ticket.

- Covers accommodation expenses for up to 10 days.

- If there is a medical recommendation, the traveler can use the insurance for the transfer or for the stay of a family member, while extending their stay.

It is an additional product and can be purchased through the online insurance comparator. If you have any questions, talk to the website team via chat.

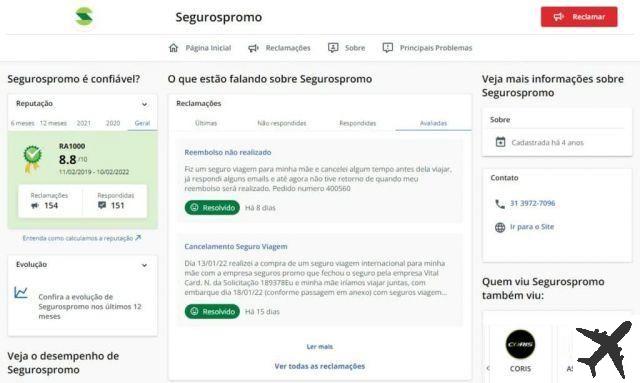

Assist Card reputation in Reclame Aqui

Like any company, the insurance company also has points that offer opportunities for improvement. Because of this, we analyzed Assist Card España's reputation on Reclame Aqui, where there are some failures regarding refund issues.

However, the resolution rate is high, with 97% of complaints resolved, and almost all of them were answered – a point in favor of the insurer. No wonder the company has a good reputation on Reclame Aqui, receiving the rating of “great”.

But remember, before taking out your travel insurance, carefully read the Assist Card's general conditions to understand how emergency care works, possible reimbursements, the situations that the plan covers and other details. Clear all doubts with the insurance company itself or at the online insurance comparator before closing the purchase, thus avoiding future problems.

FAQ

Is the Assist Card good?Yes, the Assist Card insurance company is one of the best in the travel insurance market. There are more than 45 years of exclusive experience in the sector, with more than 10 million policies sold. Check out more information about the company.

how to get insurance Assist Card trip?You can purchase an Assist Card plan by online insurance comparator. Enter your name, email address, continent, departure and return dates of your trip, and see the list of travel insurance plans available for your destination.

How much does insurance cost Assist Card?Basic Assist Card travel insurance can cost from R$11 per day, depending on the destination, while more complete plans are priced around R$29. See better the values in the comparator.

What does travel insurance cover?Travel insurance covers medical, hospital and dental emergencies occurring abroad, in addition to offering medical transfers, medical return, and many other benefits. Learn more about Assist Card plans.

What is the Telemedicine Assist Card?It is a service offered by the insurance company that allows medical consultations to be carried out by videoconference through the Assist Card application. Check out more information about the company.

What is the best Assist Card Europe travel insurance?O AC 150 + TELEMEDICINE and the AC 250 + TELEMEDICINE are some good tips for super complete plans. See other recommended options.

How is Assist Card's reputation on Reclame Aqui?The insurer is rated “excellent”, with most complaints answered. Find out more in our full post.

How does Assist Card travel insurance work?The insurer offers international travel insurance for all continents and covers 24-hour medical and hospital care. Learn all about the company in the guide.

How to use the Assist Card app?Just download the “Assist Card” app on your cell phone. Then, you will enter your details and it will be possible to consult the available doctor or other services of the insurance company. Know more.

Does Assist Card have Covid insurance?Yes, Assist Card also has travel insurance with coverage for Covid-19 diagnoses that occurred abroad. See some company plan tips.

How to contact Assist Card?There are numerous ways to activate your insurance or talk to someone from Assist Card, such as the insurance company's phone number or even the app for the insured. See more details in the post.

If you still have questions about Assist Card travel insurance, let us know in the comments!