Do you know how annual travel insurance works? Want to know more about this type of coverage? In this article, we show you what the annual plan looks like and indicate which traveler profiles it is worth. Check out!

Annual travel insurance is ideal for those who want to take a long international trip, whether for leisure, work or even a sabbatical. Hiring insurance of this type is still uncommon in Spain, but it is a practice that has grown due to the benefits, facilities and better value for money.

Also known as long-term travel insurance, this modality has some particularities that are worth knowing. In this post we explain how each modality works for you to choose the ideal one for you.

Interested? Read on to find out all about annual travel insurance.

In this post you will see:

- What is annual travel insurance?

- What is the difference between Annual Travel Insurance and Multi Trip Travel Insurance?

- Is it worth taking out annual travel insurance?

- Where to buy your annual travel insurance

- Discount coupon

- Best annual travel insurance

- UA 40 World Special

- AC 35 World Covid-19 (Except USA)

- TC 40 North America + Covid19

- Annual travel insurance coverage

- How does annual travel insurance work?

- Annual travel insurance questions and answers

What is annual travel insurance?

Annual travel insurance is a modality in which a one-year plan is contracted to guarantee medical and hospital coverage in the same destination for trips lasting up to 365 consecutive days. It is good for those traveling on business or even for those going on an exchange program.

What is the difference between Annual Travel Insurance and Multi Trip Travel Insurance?

Both types of travel insurance are valid for 1 year (365 days) but there are some particularities in both modalities.

The Multi Trip travel insurance limits the days of each trip to up to 30 consecutive days, being necessary to return to España for the policy to be automatically renewed and only then to proceed to other destinations. That is, it is not suitable for those who want to stay abroad for more than 30 days.

Annual travel insurance, or long stay, covers up to 365 consecutive days of travel in the same destination. In this modality, you are insured for the entire period you are abroad, and it is possible to renew the policy after 12 months.

Is it worth taking out annual travel insurance?

If you are going to spend a long period outside of Spain to take a course, carry out a job or any other activity of longer duration, long stay travel insurance is the best option.

Now, if you take several trips over the course of a year, and they usually last less than 30 days, then in this case we recommend Multi Trip travel insurance.

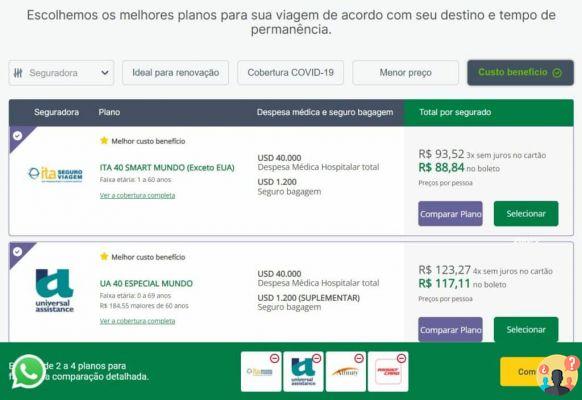

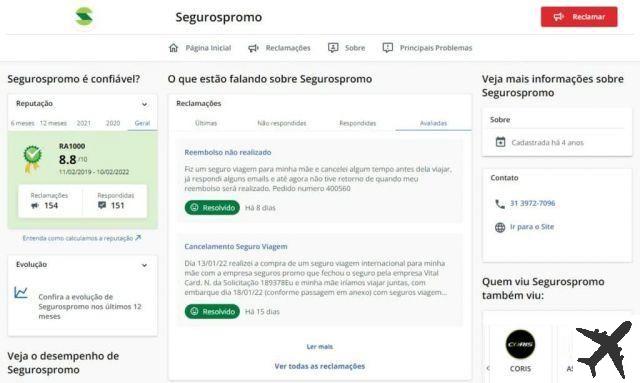

You can compare these plans in the online comparator Promo insurance which points out the main differences and similarities between the best insurers on the market.

See what the best annual travel insurance is.

Where to buy your annual travel insurance

The website of Promo insurance It's the easiest way to compare travel insurance prices and coverage. In addition to being simple and super intuitive, you can complete the purchase with a few clicks and that's it, you're already guaranteed with your annual plan.

On the website, you select the destination, enter the dates of your trip – in the case of annual insurance, it is necessary to select a period of exactly 365 days –, enter your data (name, e-mail and telephone) and click on “search”.

O online comparator will list the available insurers for you to select up to four plans and compare the details of each one, side by side and at the same time.

Compare medical and hospital expenses (DMH) coverage, sports coverage (if you plan to play any) and all other things that are important to you. After choosing, select the “buy” button. And ready! Now just fill in your personal information and finalize the transaction.

Simple, isn't it? Not to mention that the Promo insurance guarantees the best prices in the main insurance companies. In addition, you can pay up to 12 interest-free installments on your credit card.

Check out where to buy annual travel insurance.

Discount coupon

Better than being covered against possible emergencies during the trip, it is better to hire insurance at the best price on the market. For this, Travel Tips readers can use the coupon FORTRAVELOVERS and guarantee 5% off the final price. Too much, huh?

Oh, and there is an additional 5% discount for those who pay with boleto, pix or transfer, and these discounts are cumulative. That is, you can guarantee savings of up to 10% when purchasing your Multi Trip travel insurance. Also remembering that the purchase of insurance can be paid in up to 12 installments, making payment as easy as possible.

- Click to redeem coupon FORTRAVELOVERS and get 5% off

- Pay by boleto, Pix or wire transfer to earn an extra 5% and reach the 10% off!

Best annual travel insurance

Below are some of the main annual travel insurance options with the best coverage and prices on the market:

UA 40 World Special

Coverage of US$ 40 for medical and hospital expenses + US$ 1.200 for luggage insurance. It also covers sports, pregnant women, dental emergencies and also has pharmaceutical reimbursement. – SEE PRICES

AC 35 World Covid-19 (except USA)

Coverage of US$ 40 for medical and hospital expenses + US$ 1.200 for luggage insurance. It also covers sports, pregnant women, dental emergencies and medical and hospital expenses due to Covid-19. – SEE PRICES

TC 40 North America + Covid19

Coverage of US$ 40 thousand for medical and hospital expenses + US$ 1.300 for luggage insurance. It also covers all expenses related to Covid-19, dental emergencies, pharmaceutical reimbursement and even offers a $1.500 return travel guarantee. – SEE PRICES

See below for more details on the best insurers or check out other options at online comparator.

| Insurance | Universal Assistance | Assist Card | travel care |

| Plano | UA 40 World Special | AC 35 World Covid-19 (except USA) | TC 40 North America + Covid19 |

| Medical and hospital expenses | US$ 40.000 | US$ 35.000 | US$ 40.000 |

| Medical coverage for sports | Inside DMH | US$ 5.000 | - |

| coverage for pregnant women | Within DMH – Up to 28 weeks | Within DMH (per event) – Up to 28 weeks | No |

| dental coverage | US$ 500 | US$ 500 | US$ 500 |

| pharmaceutical coverage | $500 (refund) | $500 (refund) | $800 (refund) |

| Medical expenses for covid-19 | No | $30.000 (Within DMH) | US$ 10.000 |

| sanitary return | US$ 20.000 | US$ 30.000 | US$ 60.000 |

| Flight delay expenses | - | $100 (6 Hours) | US$ 300 |

| Assistance in locating lost luggage | Yes | Yes | Yes |

| Danos to mala | US$ 100 | No | US$ 300 |

| Lost luggage insurance | $1.200 (supplementary) | $1.200 (additional) | $1.300 (supplementary) |

| Legal assistance for traffic accident | US$ 1.200 | US$ 4.000 | US$ 1.500 |

| insurance value | R$ 20,17 (per day) | R$ 35,26 (per day) | R$ 52,02 (per day) |

Annual travel insurance coverage

Travel insurance usually covers some items on a standard basis, such as medical emergencies, hospital emergencies or compensation for lost luggage. And the same applies to annual travel insurance.

The most common occurrences that travel insurance covers are:

- 24-hour medical, hospital or dental care on international trips

- Sanitary repatriation

- medical transfer

- Body transfer and coverage for death while traveling

- Total disability due to accident while traveling

- Legal/financial assistance

- Death or serious illness of a family member

There are also some extra coverages that you can purchase with travel insurance:

- Support for Covid-19 and Pandemics

- trip cancellation

- Early return due to accident

- Expenses for misplaced, lost or damaged luggage

- Accidents in extreme sports

- flight delay

- Pregnant

Check out all annual travel insurance options.

How does annual travel insurance work?

Annual travel insurance works as a international travel insurance common, differing only by the period of validity. When hiring it, the traveler will be insured abroad for a period of one year, and can activate the plan several times if he needs any assistance.

It also guarantees basic coverage such as medical and hospital expenses, dental expenses, medical return, transfer of the body, loss or damage to luggage, legal assistance, among others. Remembering that some items, such as coverage for Covid-19 expenses, depend on which insurance you choose.

To claim travel insurance, you can call your policy's telephone number, free of charge, from anywhere in the world. The service is always in Portuguese. Some insurers also have mobile apps, which makes communication even easier.

Always have your policy number and personal data handy. Tell the representative about your problem and he will give you the support you need to deal with the situation – and try to stay calm to understand the instructions and get out of the situation in the best way possible.

The fundamental thing is to carefully read the travel insurance policy, and understand the particularities of the plan you hired. If you have any difficulties when talking to the insurance company, go ahead and seek help, because the important thing is to receive the support you need. Then you contact the company to resolve the financial issue.

Check out all annual travel insurance options.

Annual travel insurance questions and answers

What is annual travel insurance?It is a travel insurance plan with extended coverage of up to 365 days (12 months), for those who spend long periods abroad… Continue reading.

How to buy annual travel insurance?Access an online comparator such as Promo insurance, to list the available insurers so you can select up to four plans and compare the details of each one, side by side and at the same time. Compare the top long stay travel insurance.

How much does annual travel insurance cost?Annual travel insurance can cost, on average, from R$20 per day, depending on which insurance company you choose. See more options available in the market.

How does annual travel insurance work?Annual travel insurance, or long stay, covers up to 365 consecutive days of travel in the same destination. In this modality, you are insured for the entire period you are abroad, and it is possible to renew the policy after 12 months. Know more information.

Who is annual travel insurance suitable for?Annual travel insurance is recommended for those who will spend long periods abroad, for more than 30 days in the same destination. This is the case for students on exchange, backpacking, business trips or sabbaticals. See more information.

What is the benefit of annual travel insurance?If you are going to spend a long period outside of Spain to take a course, do a job or any other activity that lasts longer than 30 days, annual travel insurance is the best option. As this plan guarantees full travel coverage for up to 365 consecutive days. Understand better.

What does annual travel insurance cover?Annual travel insurance works like a common international travel insurance, differing only by the period of validity. When hiring it, the traveler will be insured abroad for a period of one year, and can activate the plan several times if he needs any assistance. Find out about coverage annual travel insurance.

What is the difference between annual travel insurance and Multi Trip?Annual travel insurance covers trips of up to 365 consecutive days in the same destination, while multi-trip travel insurance limits travel to up to 30 days at the destination, requiring you to return to España before starting the next trip. See all the differences between travel insurance.

Did you like annual travel insurance tips? Interested in this plan or have any questions? Comment here for us!